Are you aware that your analytical models may be biased?

Analytical models and their inherent bias

Energy companies need to value and manage risks in their portfolios. To achieve this, advanced analytical models are key. Is your company using an in-house developed model? If the answer is yes, the the second question is: are you aware of the risk that there might be bias in your model? To be fair: it is in our nature to have a blind spot for our own weaknesses. And when it comes to companies, the same applies. To overcome this short-sightedness, we propose to use industry standard KYOS analytical models. Industry-wide knowledge, coupled with our superior modelling techniques results in gold-standard analytical models. Use our superior models to calculate the most exact valuations, or benchmark your in-house developed models.

Energy companies need to value and manage risks in their portfolios. To achieve this, advanced analytical models are key. Is your company using an in-house developed model? If the answer is yes, the the second question is: are you aware of the risk that there might be bias in your model? To be fair: it is in our nature to have a blind spot for our own weaknesses. And when it comes to companies, the same applies. To overcome this short-sightedness, we propose to use industry standard KYOS analytical models. Industry-wide knowledge, coupled with our superior modelling techniques results in gold-standard analytical models. Use our superior models to calculate the most exact valuations, or benchmark your in-house developed models.

Are your valuations biased?

The portfolio of energy companies contains many assets and contracts with flexibility. To be able to properly value and risk manage in these portfolios, you will need sophisticated analytical models. Advanced mathematical theories such as Monte Carlo simulations form the backbone of these models. Some companies see the development, implementation and maintenance of such models as a core competence and as such decide to do these activities in-house. Every day, many quant developers across the industry work hard at these complex models, calibrating the model parameters to market data. Models that often get so complicated that only the quant developers themselves fully understand them! But, more importantly, understand their limitations…

Risk of bias in analytical models

To give you an example – just imagine what evolves around your internally developed model. One will be the daily management of big and complex energy portfolios, another the hedges that are required. Then you and your colleagues allocate risk capital, set risk limits and define hedge strategies. And all based on the same set of models. Moreover, based on the same model results, management decides and inform shareholders on the P&L and risk position of their company.

Would you really want that the decisions you take rely only on in-house developed models? Do you actually know how different they are to the models in other companies? Are you aware that models for different applications often use the same basis? Given the fact that the same developers are behind these models, it should not come as a surprise that these models may all exhibit similar behavior. What would be the impact on your company if the in-house models exhibit a structural bias? What if these models always underestimate the risk in certain price scenarios?

Bench-marking is best practice

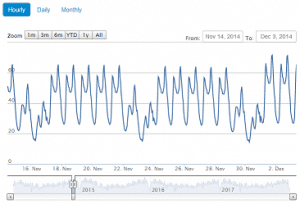

Bench-marking internally created models with one or more externally developed models is the norm in the financial sector: already before the economic crisis of 2009, but this behavior got even more in use after 2009. There are various ways to perform this bench-marking. Typically, banks run external valuations on a regular basis for a portfolio with a set of key contract types. In order to stress-test the models, these benchmarks can be done for a range of historical market prices to mimic many different market scenarios. In this way you can discover weaknesses of the model and obtain a better understanding of the validity of the risk numbers. If necessary, companies adjust their own models based on these external benchmarks.

Bench-marking internally created models with one or more externally developed models is the norm in the financial sector: already before the economic crisis of 2009, but this behavior got even more in use after 2009. There are various ways to perform this bench-marking. Typically, banks run external valuations on a regular basis for a portfolio with a set of key contract types. In order to stress-test the models, these benchmarks can be done for a range of historical market prices to mimic many different market scenarios. In this way you can discover weaknesses of the model and obtain a better understanding of the validity of the risk numbers. If necessary, companies adjust their own models based on these external benchmarks.

Given the current complexity of the portfolios of energy trading companies, bench-marking models with other models should become best practice in the energy sector as well.

How can KYOS support

KYOS has developed best in class analytical models for most of the commonly used energy contract types. Numerous energy companies and traders across Europe already use KYOS analytical models to their complete satisfaction! The KYOS Analytical Platform integrates all models into a single user-interface. It is specifically designed for an optimal and intuitive user experience. Of course it is also possible to incorporate the KYOS platform into your own ETRM system.

KYOS can support your company in three ways to avoid bias of your valuations and risk reports:

- Use KYOS analytical models as the standard models in your company. This ensures that your company has valuations that are in-line with the industry. Separately, companies can benchmark the KYOS models with in-house developed tools.

- Benchmark your existing models with KYOS analytical models. Use the KYOS models in parallel to your existing models to identify valuation differences in an early stage. Alternatively, run them on a regular basis on a test portfolio.

- KYOS can perform a bench-marking study of your existing models. KYOS will test your existing models under various market conditions, and compare these results to KYOS’ models. We will give you tailored advice on where and how you might have bias in your models.

Avoid the bias trap and start using KYOS’ full range of analytical models!

For more information on how KYOS can support your company in validating models, fill in the contact form below or contact Ewout Eijkelenboom directly at Ewout@kyos.com