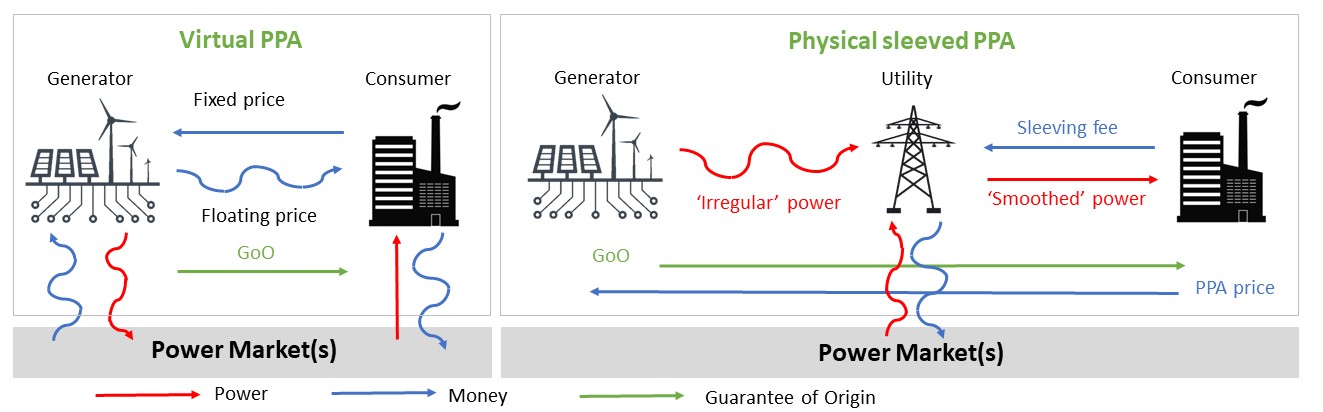

What is the difference between a virtual and physical PPA?

There are basically two types of power purchase agreements, PPAs: virtual (financial) and physical. A virtual PPA is a financial contract in which the connection between the renewable generation asset and the off-taker is quite loose. For example, the off-take may be in a different market area than the location of the asset. A virtual PPA with a fixed price is essentially a contract-for-differences: for each MWh of power produced by the generator, the buyer pays a price to the generator equal to the fixed price. In return it receives from the generator a variable (spot) price plus the Guarantees of Origin (GoOs).

Physical PPA

In a physical PPA structure, the generator and the off-taker must be on the same grid. A physical PPA is generally sleeved by a utility. This means that a utility is in between the generator and the off-taker to deliver the actual electricity, especially to manage the volume fluctuations. For this activity, the utility receives a sleeving fee – which is why a physical PPA is also called a sleeved PPA.

A natural role for a utility is to manage volume fluctuations of an energy portfolio, whereas this is not a natural role for a corporate consumer. Unless the generator is a utility itself, many physical corporate PPAs have a utility to “sleeve” the volumes from generator to corporate consumer.

In such a sleeved corporate PPA, the utility takes care of the short-term forecasting of the production, the daily nominations to the network operator and the short-term balancing, in return for a sleeving fee. In fact, the utility transforms the irregular flow of the renewable generator into a smoother flow for the consumer. With sufficient scale in such operations, a utility benefits from economies of scale and diversification to be of real added value.

KYOS PPA software and services

KYOS is a recognized expert in the renewable PPA market. We support clients in all financial aspects of the PPA life-cycle with an unrivalled software suite for the valuation and risk management of PPA contracts. Our dedicated and experienced team acts as advisor to individual transactions and helps companies execute a sound risk management strategy. Contact us for more information: info@kyos.com.