Japan will benefit from forward power trading

Spot power prices in Japan have been extremely high for almost 4 weeks. No other major power market in the world has ever seen such an extended period of high prices. This situation is likely to result in large losses among PPS companies and even some bankruptcies. In this article we compare the situation in Japan to a similar situation in France in 2016. We use this to demonstrate the importance of market transparency, forward trading and risk management, which can help to avoid the Japanese situation from happening again.

High spot prices Japanese market

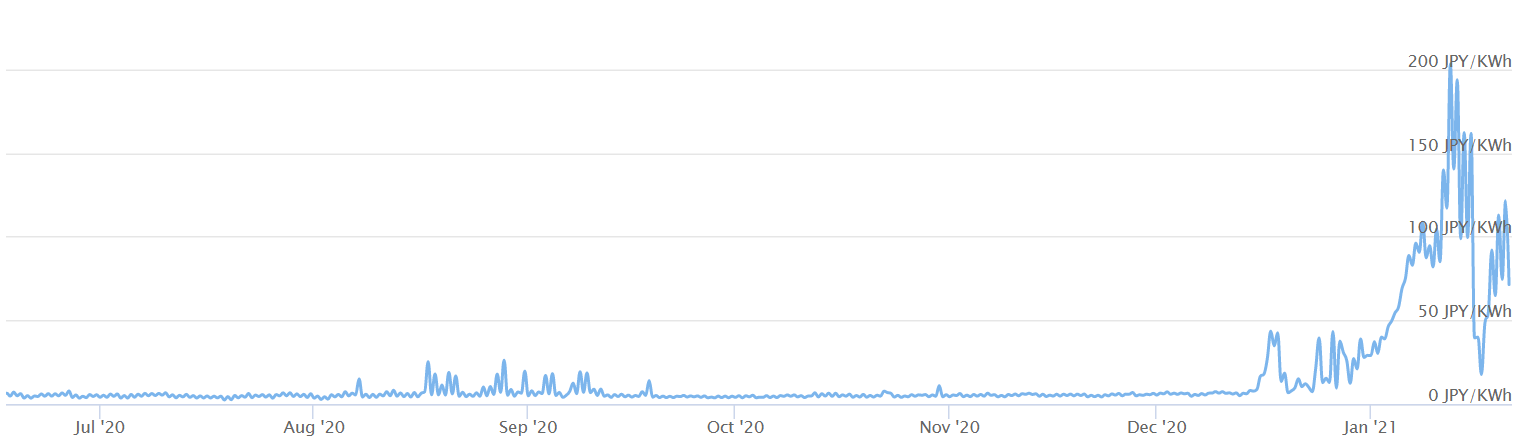

For many years, Japanese power prices have been around 10 yen/kWh. Suddenly in mid-December 2020 however, the prices on the Japanese JEPX spot market started a steep rise which lasts until the current date (25 January 2021). In the Tokyo area, where the prices soared the most, levels of over 250 yen/kWh (2,000 €/MWh) were reached, with an average January price that is almost 10x higher than usual. Figure 1 shows how Tokyo spot prices started their steep ascent around 20 December 2020 and have only somewhat come down after the all-time high on 15 January 2021.

There has been a lot of debate about the causes of this unprecedented price rally. The direct reasons are relatively clear: cold and snowy weather, a shortage of LNG supplies and limited availability of power plants. The relatively cold temperatures, in combination with the lockdown, has boosted electricity consumption for residential heating. Snowfall has reduced the output of solar generation. At the same time, Japan faced shortages in LNG supplies. These shortages are also felt in other parts of the world, and resulted in all-time high prices for LNG. Figure 2 shows the JKM front-month futures prices for LNG, at 15 $/mmBtu, more than 2-3 times higher than normal. In the spot market, Platt’s reported even prices of over 30 $/mmBtu.

Nuclear, LNG and solar generation together represent approximately 55% of the total installed capacity. Each of these had less capacity than normal in January this year. First of all, Japanese power generators feared depleted LNG inventories, and had to cut back production. At the same time, 3 out of 9 active nuclear reactors in Japan were undergoing maintenance and repairs in January, reducing nuclear capacity by about 1/3. Finally, snowfall covered part of the solar PV panels in the country. All these factors together caused the sharp rise of Japanese power prices.

Comparison to the French market situation

Price spikes are not unique for Japan, and have happened in many power markets around the globe. However, such spikes tend to last no longer than a few days, and are very rarely more than 3-4 times above normal. So, why was the market outcome so much more extreme in Japan? And why were there no warning signals? We will analyze what is special about the Japanese market situation and what remedies can be taken.

Many elements of the Japanese power market are similar to those in the European power markets. There is a liquid day-ahead spot market, efficiently bringing supply and demand together. Supply is a mix of coal, gas (LNG) and nuclear power stations, together with renewable sources from hydro, solar and wind.

All markets occasionally experience supply disruptions and a tight supply-demand balance. A most interesting example is the French spike in power prices towards the end of 2016. There were worries about upcoming shortages of power generation capacity in the winter, because a lot of nuclear power stations were in repair or under inspection.

Difference with Japan #1

There is a lot of information available about planned and actual power station capacities. This is enforced by EU regulation in all member states. Although the information from French nuclear giant EdF was far from perfect, there was enough information to warn market participants and to stimulate further investigations.

Difference with Japan #2

There is a well-functioning forward and futures market, enhancing the process of price discovery. In France, the news of potential supply shortages, lead to larger buy volumes for power deliveries in the upcoming winter, such as December 2016. This raised forward prices for the months ahead and provided a sound incentive for market participants to act: generators were preparing for maximum capacity, network operators for maximum connectivity, and (industrial) end-users for reduced demand. All of this happened well ahead of the actual problems.

Difference with Japan #3

Market participants in Europe have widely adopted professional systems (ETRM systems) to manage their market price risks. These systems provide warning signals if the portfolio is too much at-risk. To limit their risks, European suppliers (PPS companies) buy the bulk of their volumes on the forward market and only smaller volumes on the spot market. Likewise, generators sell most of their output on the forward market too.

To understand the important role of forward markets in European power, we look at some price developments in France in 2016. The baseload forward price for delivery in December 2016 was initially trading around 40 €/MWh. When winter came closer, the price gradually increased to almost 140 by the beginning of November (figure 3). Eventually, in December the supply-demand balance was somewhat tight, but not as tight as many had feared. Hence, average spot prices in December were slightly above average at 59 €/MWh.

To summarize: what differentiates the French situation from that in Japan, is that participants could anticipate on a potentially disruptive event. Generators had the time to think of ways to increase production, while offtakers could think of ways to reduce demand. After the panic, and after the mitigating actions by many market participants, no accident happened.

Way forward for the Japanese power market

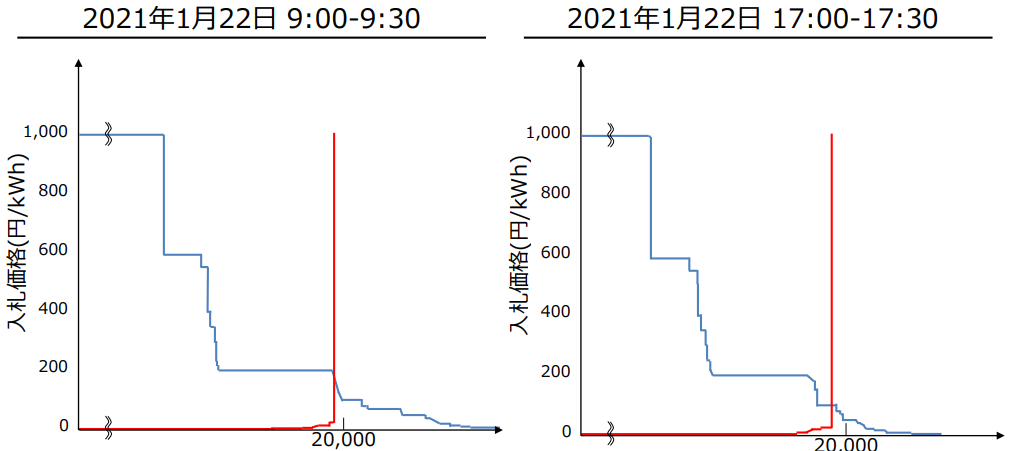

Transparency is an important condition for a well-functioning market. A positive development is that Electricity and Gas Transaction Monitoring Committee has decided very recently to publish the bid ladder. The bid ladder shows how much capacity is offered and against what price, and likewise for the demanded capacities and prices (red and blue lines in figure 4). This information assists market participants to understand how market fundamentals are translated in a clearing price.

Figure 4: Bid and offer curves for 2 half-hours on 22 January 2021. The x-axis shows the total volume, the y-axis the price for the supply (red) and demand (blue). Source: METI.

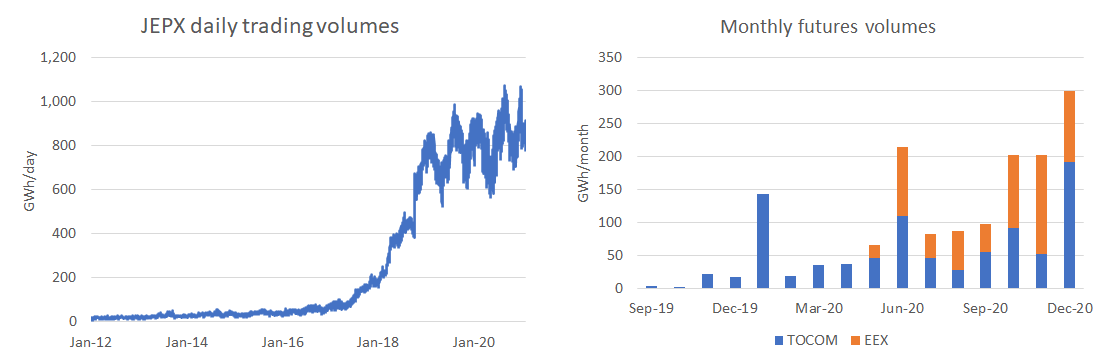

Another positive development is the establishment futures markets for Japanese power. The exchanges are operated by TOCOM and EEX and have since 2019 and 2020 offered the possibility to trade power futures. Until now, the trading volumes have been very limited, only a fraction of the volume on the JEPX spot market. In December 2020, the combined EEX and Tocom trading volume was 300 GWh, which is 1% of the spot trading volume (figure 4). It is important that more local market participants make use of futures to manage their price risks, and that more overseas traders enter the market to boost the liquidity.

Finally, an important development is the adoption of active risk management. This is supported by the use of a professional Energy Trade and Risk Management (ETRM). Such systems provide direct and clear insights in the current and future positions. They quantify the daily risk by calculating how much money may be lost as a result of market price movements. And they indicate what trades should be done to mitigate these risks.

Conclusion

There is a close connection between all of the elements. Market transparency removes hurdles to trade on the forward market. With more forward trading volumes, market participants can manage their risks more effectively. And with a larger trading activity, the need for a system to accurately capture these trades becomes evident. While the path is clear and has been followed in other markets, the Japanese market should be supported to follow this same path, with the aim to stabilize market prices.

To read this article in pdf: High power prices in Japan January 2021

Cyriel de Jong, Hans van Dijken

KYOS Energy Analytics

+81 (0) 3 6869 6646 / +31 (0)23 5510221