Value-at-Risk

- Calculate the market risk of a complete portfolio

- Locate and analyse the key risk drivers

- Enjoy user-friendly interface and fast calculations

- Choose between different methodologies

Benefits

1. Foresee potential losses

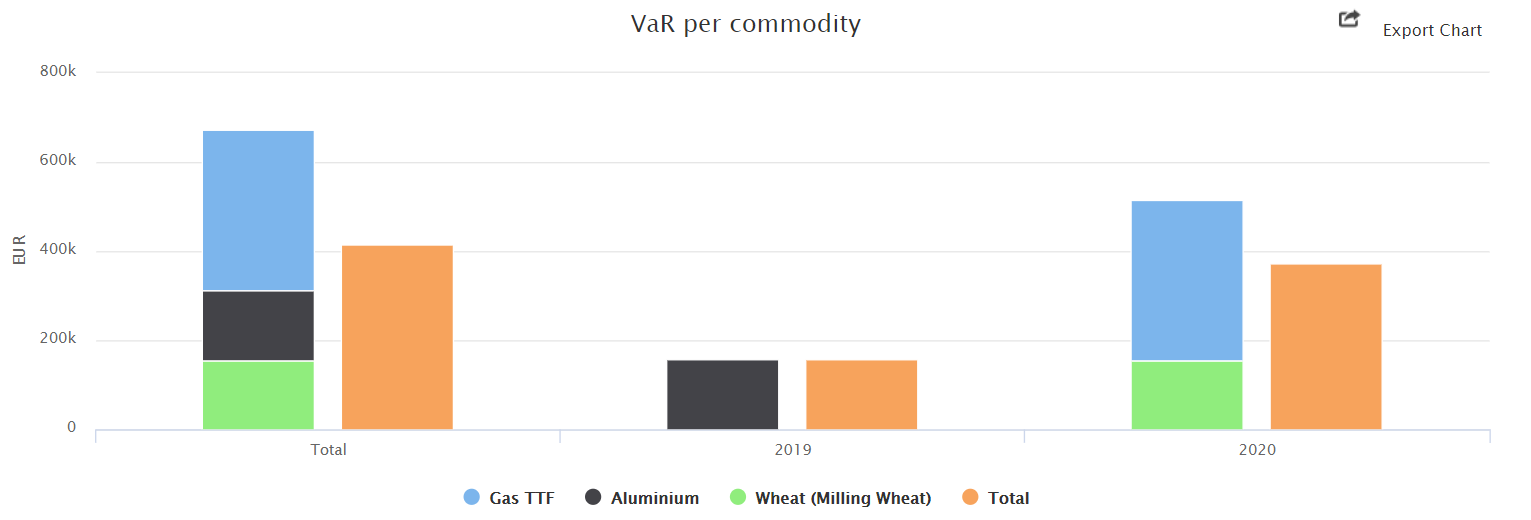

Value-at-Risk calculates by how much the market value of the portfolio may change over a given horizon with a certain confidence level. For example, a 10-day 95% VaR of 1 mln USD means that the drop in market value over a 10-day period will not be more than 1 mln USD in 95% of the cases. Besides that, the KYOS KyVaR model includes positions arising from all contracts and assets (power plants, gas storage, swing contract). It is possible to compare the VaR with the market risk on previous trading days, thereby highlighting potential trends. The model displays the VaR in a flexible format, so the user can identify the main sources of risk: per book, per commodity or per period.

2. Locate the drivers of market risk

The main drivers for the Value-at-Risk are (i) the positions and (ii) the price volatility of commodity markets. The VaR model shows both the positions and the volatility per month, giving full insight in the risk drivers.

3. Check if trading limits are not breached

Each day the model compares the calculated VaR with the appropriate VaR limit. You can set the limit on the total portfolio, but also on a sub-level (book, commodity, etc.). In case a VaR limit is breached, a clear signal is given which can be used to reduce market risk.

Loading a qoute..

Loading a qoute..

Features Value-at-Risk

All exposures are included in the VaR model: not only contracts, but also positions from energy assets including power plants, swing contracts and gas storages.

Of course we have made sure to fully embed KyVaR in the KYOS Analytical Platform. Automated data feeds ensure that you get up-to-date VaR calculations every day.

Methodology

The standard VaR model in the KYOS Analytical Platform is based on the variance-covariance matrix. It is referred to as parametric VaR, normal VaR or varcovar VaR. It is actually the most easy to use and interpret results. As an input it requires the volatilities and correlations of all monthly prices. Historical market prices from the basis to automatically calculate these parameters. The user may overwrite the volatility estimates, either to test sensitivities or because he has more accurate estimates from option markets.

As alternative methodologies, KYOS offers the Monte Carlo simulation approach and the historical simulation approach. Especially when the market price returns do not have a very nice Normal distribution, this may be more accurate. For the Monte Carlo simulation approach, we are using the price simulations from KySim. For the historical simulation approach, the model takes the variations in market prices directly from the history, without any distribution assumption; that is therefore the non-parametric VaR approach.

Risk analytics

Trusted by organizations all over the world

Other Solutions

Consulting services

KYOS Energy Consulting offers a wide range of services to support companies with managing their (renewable) production position. Our expert services range from a one-off deal valuation to a complete solution for the risk management of a portfolio of renewable generation assets and contracts.

Read more ›Optimization and valuation

KYOS offers fast and accurate solutions to value flexible assets and contracts in energy markets, such as power plants, gas storage facilities and swing contracts.

Read more ›Portfolio & risk management / CTRM

Does your company have a significant exposure to commodity prices? Then KYOS has a cost-effective solution for your daily management. The KYOS CTRM offers a detailed insight in your exposures, expected cash-flows, Mark-to-Market and more.

Read more ›Price simulations and analytics

Market prices, market price forecasts and simulations are essential ingredients in energy and commodity management. KYOS offers a suite of functions and quant models to create and analyze all these price series.

Read more ›