Cashflow / Earnings-at-Risk

- Assess distributions of cashflows and earnings

- Apply to complete portfolio of contracts and assets

- Make optimal hedge decisions on forward markets

- Get helicopter view for management, full details for analyst

Benefits

1. Assess potential future losses over longer horizons

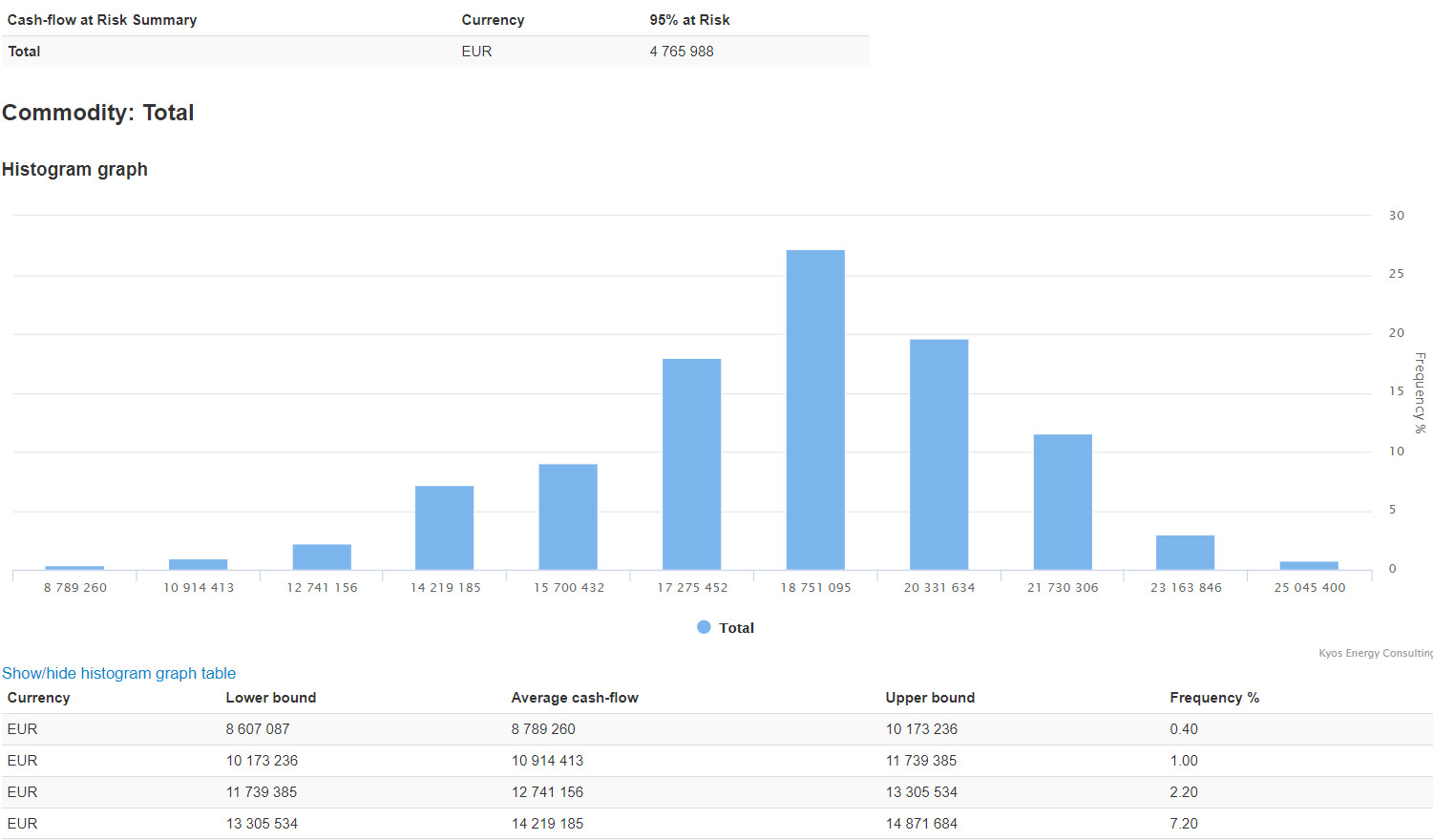

The AtRisk model calculates possible cash-flow and earnings distributions over the user defined horizon. It shows the expected cash-flows and earnings per month, and also the cumulative results over time. Use the cash-flow projections directly in liquidity forecasts, and help to avoid unexpected losses. The earnings projections especially provide insight into the worst-case scenarios.

2. Find hedges that protect during unfavorable market conditions

Besides calculating the distribution of cash-flows and earnings, the AtRisk model helps you to find the optimal hedges. These are the forward trades which offer the best protection in case of adverse market movements. The model calculates optimal hedges over the combination of contracts and assets (power plants, gas storage, etc). The result of the hedge optimization may be directly executed in the market.

Loading a qoute..

Loading a qoute..

Loading a qoute..

Loading a qoute..

3. Different from Value-at-Risk

KYOS offers Cashflow-at-Risk / Earnings-at-Risk (AtRisk model) in addition to the Value-at-Risk. Value-at-Risk is the standard risk metric for banks and many other financial or trading oriented companies. It measures the potential loss in market value of their trading book between today and some future day, typically tomorrow. In contrast, the AtRisk models are more common in organisations which are less trading oriented, for example because they are processors, producers, shippers or simply active in less liquid markets. Their horizon is typically longer than a single day and the final cash-flows or earnings are more relevant than the day-to-day value changes. KYOS specialists can advise which approach is most suitable for your company.

Features

The model calculates the Cashflow-at-Risk and Earnings-at-Risk over all possible contract structures, including fixed price, spot indexed, and forward indexed.

Of course we have made sure that we fully embedded the AtRisk model and the accompanying simulation model KySim in the KYOS Analytical Platform. This make the application easy to use,and also allows you to disseminate the results to any person in your organisation.

Methodology

The AtRisk model combines a number of inputs to calculate the distributions:

- Hundreds or thousands of price scenarios from KySim (spot and forward)

- All parameters of the contracts: volumes, fixed and variable components of the contract price, past settlements, price clicks, etc.

- For storage, swing, power plant and option contracts: the optimal exercise and corresponding cashflows and earnings. These come from KyPlant, KyStore and KySwing

Trusted by organizations all over the world

Other Solutions

Software - Energy Analytics

Do you need help with valuing a renewable investment project, PPAs, battery energy storage, power plant, electrolyser, gas storage, - or you need bankable price forecasting services, risk management advisory or an E-/CTRM system?

Read more ›Software - C/ETRM

Customize your own C/ETRM system, with advanced risk metrics and reporting tools. Bring together your physical commodity positions with financial contracts. This provides not only a complete picture of purchases and sales, but also of the financial risks you are exposed to.

Read more ›Price Analytics

Market prices, market price forecasts and simulations for short and long-term are essential ingredients in energy and commodity management. KYOS offers a suite of functions and quant models to create and analyze all these price series.

Read more ›Advisory & Data Services

KYOS Energy Consulting offers a wide range of services to support companies with managing their (renewable) production position. Our expert services range from a one-off deal valuation to a complete solution for the risk management of a portfolio of renewable generation assets and contracts.

Read more ›