Renewable power

- All market and forward price curves included

- Flexible deal capturing

- Assess your risk positions and adjust your hedges accordingly

(Renewable) PPA Valuation

To begin with, Power Purchase Agreements, or PPAs often include complex pricing structures. For example, PPA’s typically consist of price floors, risk sharing elements and specific reconciliation mechanisms. In order to value your assets, you need a system that is able to capture all this.

Our PPA module offers

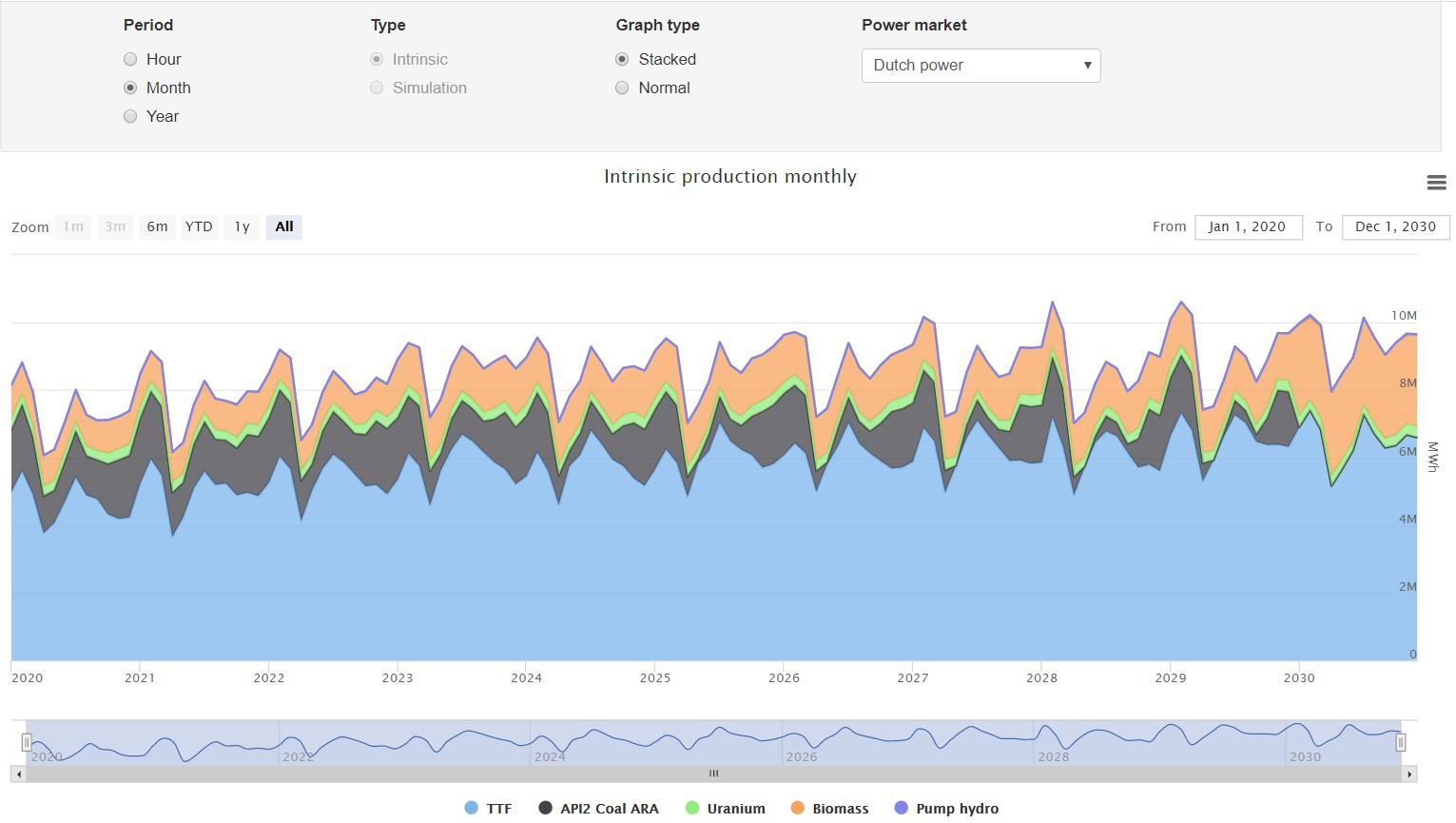

- A fundamental power market model to create long-term electricity price forward curves, important given the long duration of many PPAs.

- Software modules to simulate price and volume risks. These are necessary if you wish to assess the future earnings and hedging strategies.

- Furthermore, capture rate is an important parameter for PPA valuations. Our system can calculate this using historical data or using long-term fundamental price forward curves. Alternatively, the user can define its own capture rate.

- A flexible tool for accurate PPA valuations. Breakdown the value in different components. Possibility to define own pricing structures.

- The option to evaluate and monitor the risk of one or more PPAs or as part of a larger portfolio, with or without hedging strategies.

KYOS offers support to value renewable Power Purchase Agreements (PPA). We accompany you through the entire PPA life cycle, with pricing, risk analytics and dispute resolution. We help you in getting the best deal for your PPA!

Use the KYOS PPA module in the following cases:

Deal valuation

KYOS performs the main valuation of the PPA for either buyer or seller. In addition, we can also provide advice in structuring the PPA to make sure it is aligned with your company’s risk profile. This can be a one-off valuation request or under a framework agreement.

Second opinion

Another reason to use the KYOS valuations is when you wish to benchmark your own, internal, valuations.

Dispute support

Moreover, we are impartial. KYOS performs independent valuation of existing PPAs. Many PPAs have been concluded some years ago, and might include ambiguities which could lead to disputes between contract parties. We provide reliable support to settle such disputes in a fair way.

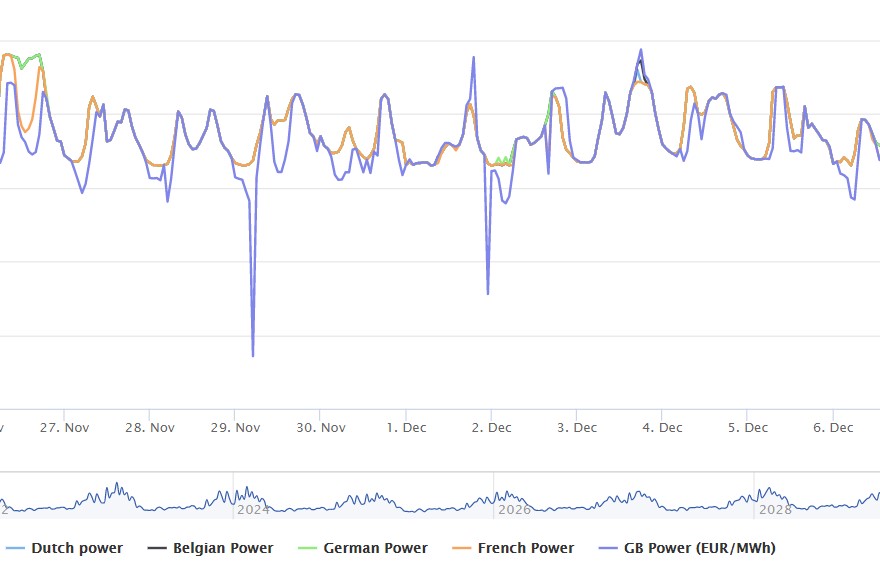

Data Services for renewable power assets

Generally speaking, market prices are at the basis of almost any function within energy and commodity management. The KYOS Platform offers various price simulations and packages. Of course we have made sure our price simulations can easily interface with data providers, storing all the data in a central price database. Furthermore, there is a range of standard functions for analyzing the data visually, and to export prices to Excel. The Platform also contains functions to analyze price spreads and calculate volatilities and correlations.

All data services can be delivered for one or more power markets in Europe, Turkey, and Japan. We have four options available:

Daily:

- Service A, daily: Forward, futures and spot power market prices of relevant markets

- Service B, daily: Market-based hourly price forward curves up to end of current year, year +1, year +2

Monthly:

- Service C: monthly, long-term fundamental hourly price forward curves for current year, year +1, year +2

- Service D, monthly: PPA valuation and risk metrics of a specific renewable asset

The KYOS PPA software module has a market price and forward curve database and uses an advanced Monte Carlo simulation engine – perfect to value all PPA characteristics. Add various reporting and risk management tools.

# 1 Provider of analytical solutions for valuing renewable assets

Software modules for renewable power assets and PPA’s

Basically, the KYOS renewable risk management system provides a complete picture of the electricity portfolio with renewable energy PPAs and related hedges. As an illustration, reporting includes volumetric position, mark-to-market value, value-at-risk and earnings-at-risk. All modules are part of the KYOS Analytical Platform, a cloud-based software platform.

KYOS puts a lot of effort to find the right balance between offering a robust deal capture system and a fully flexible spreadsheet solution. We include standard PPA pricing mechanisms for certain countries and technologies. Additionally we offer you the unique feature to add your own pricing structures to the system. For this purpose, we offer an easy-to-use Python programming interface.

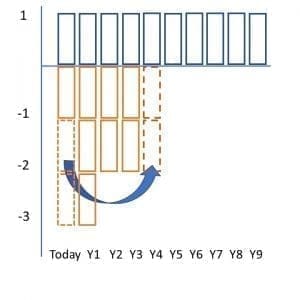

The KYOS renewable risk management system allows the user to analyze the effect of applying different hedging strategies to lock-in value of your renewable project. Strategies range from basic static hedges to advanced stack and roll strategies. If your project is in a market with limited liquidity, our system will show you the effectiveness of proxy hedging the exposure in other markets, even using different commodities than electricity.

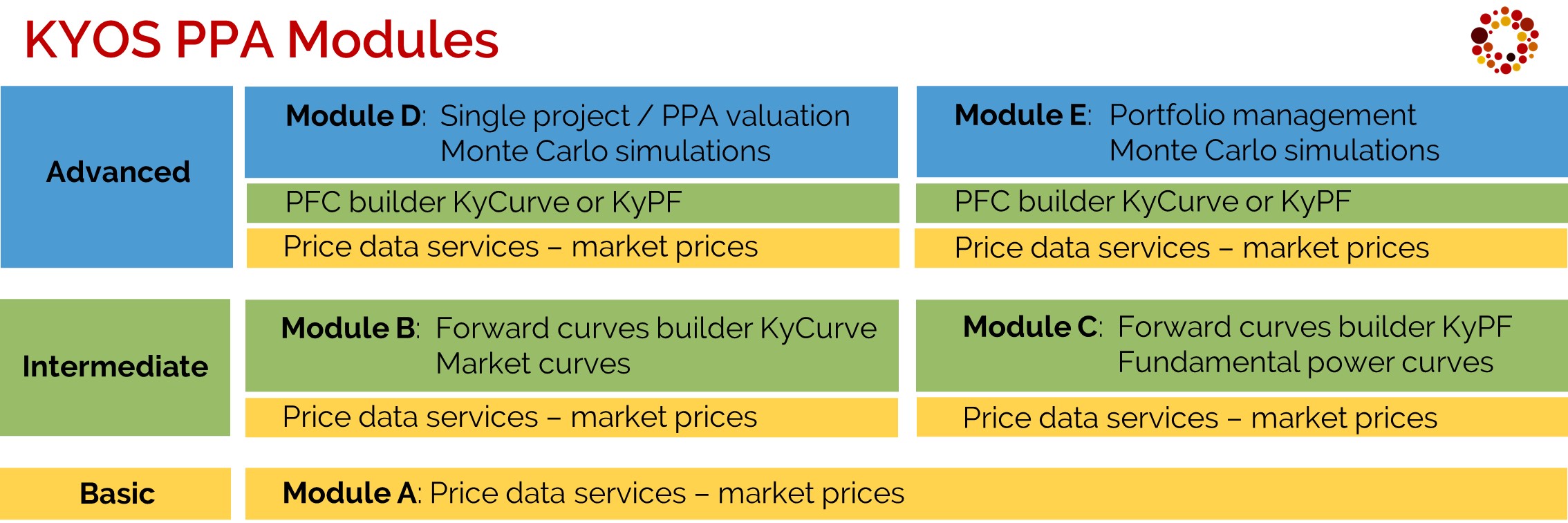

We have various options available in our KyPPA renewable power model:

Module A: Price data services

- Forward, futures and spot prices at your fingertips, with our price data management system.

- Automate price data imports. Of course, built-in interfaces to most popular European exchanges are standard.

- Along with price data, you will have access to analysis tools, spread calculator, etc.

Module B: Price data plus market price forward curve builder

- Includes forward curve builder KyCurve, to generate your own market-based hourly forward price curves.

- Create accurate arbitrage-free hourly forward price curves. In addition, workflow can be fully automated. For example price data import, curve creation and export for use in external systems.

Module C: Price data plus fundamental power curve builder

- Contains fundamental power market model KyPF, including quarterly updated power plant datasets.

- This allows you for instance to run your own merit order analysis, forecast power prices and perform what-if scenario analysis.

- It also provides forecast capture rates of individual renewable generation assets and technologies

Module D: all above plus Monte Carlo simulations for single project

- Complete PPA valuation and risk software – Monte Carlo.

- Define your own PPA parameters, run our capture rate calculator and obtain a forecast of the future PPA cash-flows.

- Generate Monte Carlo scenarios of future power prices and renewable generation volumes.

- To begin with, you define future expected capture rates, then the model ensures the volume and price scenarios are in line with those rates, incorporating the cannibalization effect.

- Compare the cash-flows of the PPA with sourcing power directly from the market to assess profits or losses. Also assess different dynamic hedging strategies, such as stack-and-roll and proxy hedging.

- Break down of results helps to understand value drivers and risks, such as capture rate, market price, generation volume and balancing costs.

Module E: all above plus Monte Carlo simulations for portfolio

- Full portfolio and risk management system for all your power trades and PPA contracts.

- Our most comprehensive module – in short, KYOS offers a uniquely complete and proven system to manage your portfolio.

- Whether you have just futures and forwards, or also complex PPA structures with price indexation, market-price clicks, caps and floors: the KYOS system manages your positions.

- Also assess the effect of different dynamic hedging strategies, such as stack-and-roll and proxy hedging

For more information or a free demonstration of our KyPPA renewable power model, please do not hesitate to contact us: info@kyos.com.

Trusted by organizations all over the world

Other Industries

Power

Where are power prices going? What is the value of my power station or contract? How can I trade in the market to reduce electricity price risks? KYOS analytics provide answers.

Read more ›Renewable power

Sources of renewable power or green energy are the future. KYOS helps you with valuing your solar, wind, battery or pumped-hydro energy assets, as well as your (renewable) power purchase agreements (PPAs).

Read more ›Natural gas

Natural gas portfolio management is all about managing price and volume risks. KYOS helps to optimize natural gas storage and swing contracts, and trade in the markets to maximize the flexibility value.

Read more ›Green hydrogen

Green hydrogen is going to play a key role in the energy transition. Learn about the business cases for which we provide advisory services.

Read more ›Multi-commodity

Large industrial companies are exposed to a variety of commodities. To successfully operate in a competitive market, commodity earnings risk should be well understood and managed effectively.

Read more ›