Swing contract

- Increase revenue & manage risks of gas swing contracts

- Capture all indexations and volume constraints

- Make quick calculations, fully automated

- Enjoy easy interfaces with market and other data

- Calculate accurate values and hedges with Monte Carlo simulations

Swing options are typical components of gas contracts, which offer the opportunity to vary the contracted volume under a number of restrictions. They are also known as Take-or-Pay (ToP), interruptible and variable load contracts.

Benefits

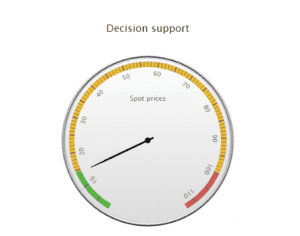

1. Spot optimization: daily off-take?

Each day in the contract period, the swing valuation advises how much gas should be taken from the contract. For example, boundary prices show above which price the maximum contract quantity should be nominated, and below which price the minimum quantity should be nominated. Together with boundary prices of other storage assets and swing contracts, a portfolio manager can rank the assets from low opportunity cost to high opportunity cost. As a result, creating an internal merit order for portfolio optimization is easy.

Each day in the contract period, the swing valuation advises how much gas should be taken from the contract. For example, boundary prices show above which price the maximum contract quantity should be nominated, and below which price the minimum quantity should be nominated. Together with boundary prices of other storage assets and swing contracts, a portfolio manager can rank the assets from low opportunity cost to high opportunity cost. As a result, creating an internal merit order for portfolio optimization is easy.

2. Forward Market: Keep the risk or lock in profits?

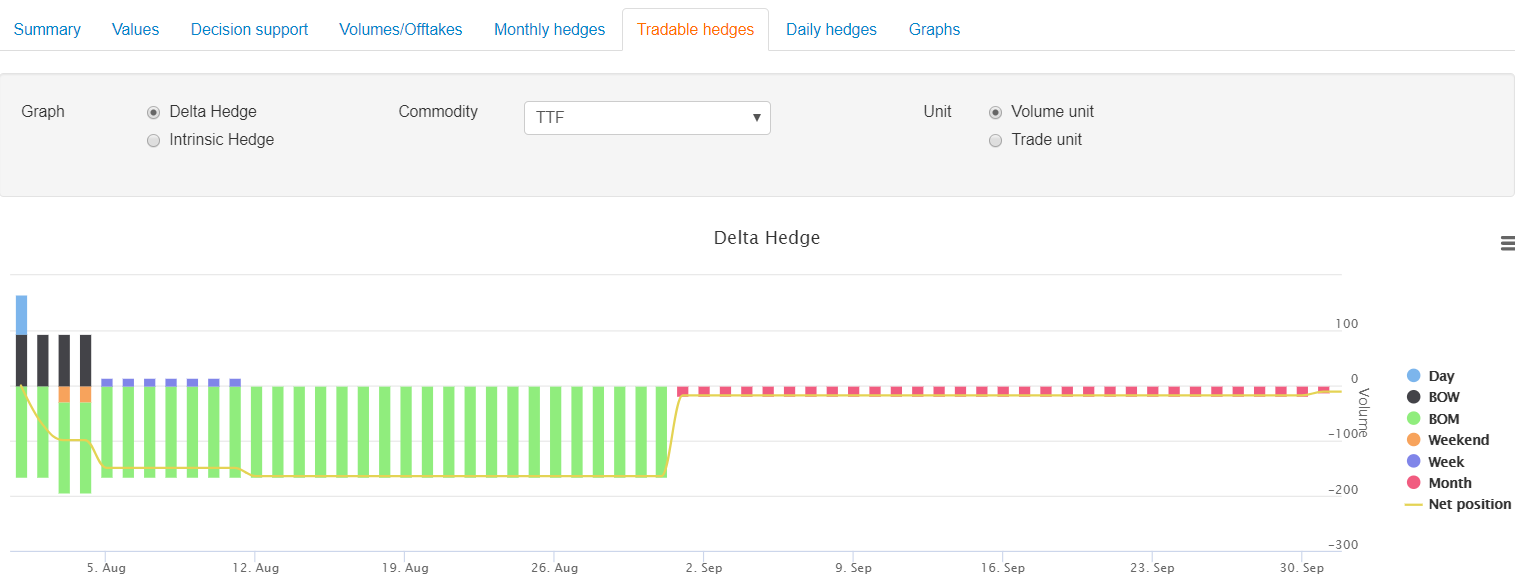

KySwing advises what forward transactions are optimal to hedge the risks and lock in profits. The user can choose between intrinsic and delta hedging, two strategies to secure profits. It can not only provide hedge recommendations for the asset alone, but also for multiple assets together or for a portfolio of assets.

3. Contract valuation: what is a fair price?

The swing model calculates the fair price of a swing contract. The model shows which part of the value is intrinsic, and can be made easily. It also shows which part is extrinsic, requiring a more active trading strategy. With an intuitive and realistic Monte Carlo simulation model, it is easy to derive extrinsic values.

KySwing applies a combination of forward and spot trading strategies to the simulated price scenarios, using rolling intrinsic and least-squares Monte Carlo. Therefore, this type of valuation provides a fair assessment of the future value. Finally, backtesting of the model is another feature: it shows how much money you would have made in the past, following a specific trading strategy.

Loading a qoute..

Loading a qoute..

Features

Furthermore, we include all contract constraints in the optimization. This includes volumetric constraints on one or more periods (e.g. daily, monthly and annual contract constraints). In addition, KySwing accepts contracts based on a variety of spot and forward indexed products.

KySwing is fully embedded in the KYOS Analytical Platform. With automated data feeds, up-to-date swing valuations are always available. Furthermore, it is possible to establish further integration with third party ETRM systems.

Methodology

KySwing is based on advanced Monte Carlo simulation techniques. Important characteristics are a mean-reverting multi-factor model with long-term, short-term and seasonal dynamics. Users can also import their own price simulations, or use those of KySim.

The model applies Least Squares Monte Carlo techniques to calculate the optimal trading and operating decisions. The accompanying calibration tool uses historical data to easily derive the volatility term structure and other simulation inputs. Similarly, implied option volatilities may be used as well, by overwriting the historical volatility estimates.

Optimization modules

Publications

- A practical example of hedging gas swing contracts

- White paper: Benefits of outsourcing energy analytics

- Journal of Energy Markets: Gas storage valuation using a multi-factor price process

- Journal of Energy Markets: Cointegration between gas and power spot prices

- Journal of Derivatives: Gas storage valuation using a Monte Carlo method

Trusted by organizations all over the world

Other Solutions

Consulting services

KYOS Energy Consulting offers a wide range of services to support companies with managing their (renewable) production position. Our expert services range from a one-off deal valuation to a complete solution for the risk management of a portfolio of renewable generation assets and contracts.

Read more ›Portfolio & risk management / CTRM

Does your company have a significant exposure to commodity prices? Then KYOS has a cost-effective solution for your daily management. The KYOS CTRM offers a detailed insight in your exposures, expected cash-flows, Mark-to-Market and more.

Read more ›Risk analytics

KYOS offers unique software for measuring portfolio risks in energy and commodity markets. The risk analytics include Value-at-Risk, Cashflow-at-Risk and Earnings-at-Risk.

Read more ›Price simulations and analytics

Market prices, market price forecasts and simulations are essential ingredients in energy and commodity management. KYOS offers a suite of functions and quant models to create and analyze all these price series.

Read more ›