Natural gas storage operators

Owners of natural gas storage need to have a full understanding of the trading value of their facilities. That helps natural gas storage operators with their own trading operations and with the pricing and structuring of products they sell to third parties.

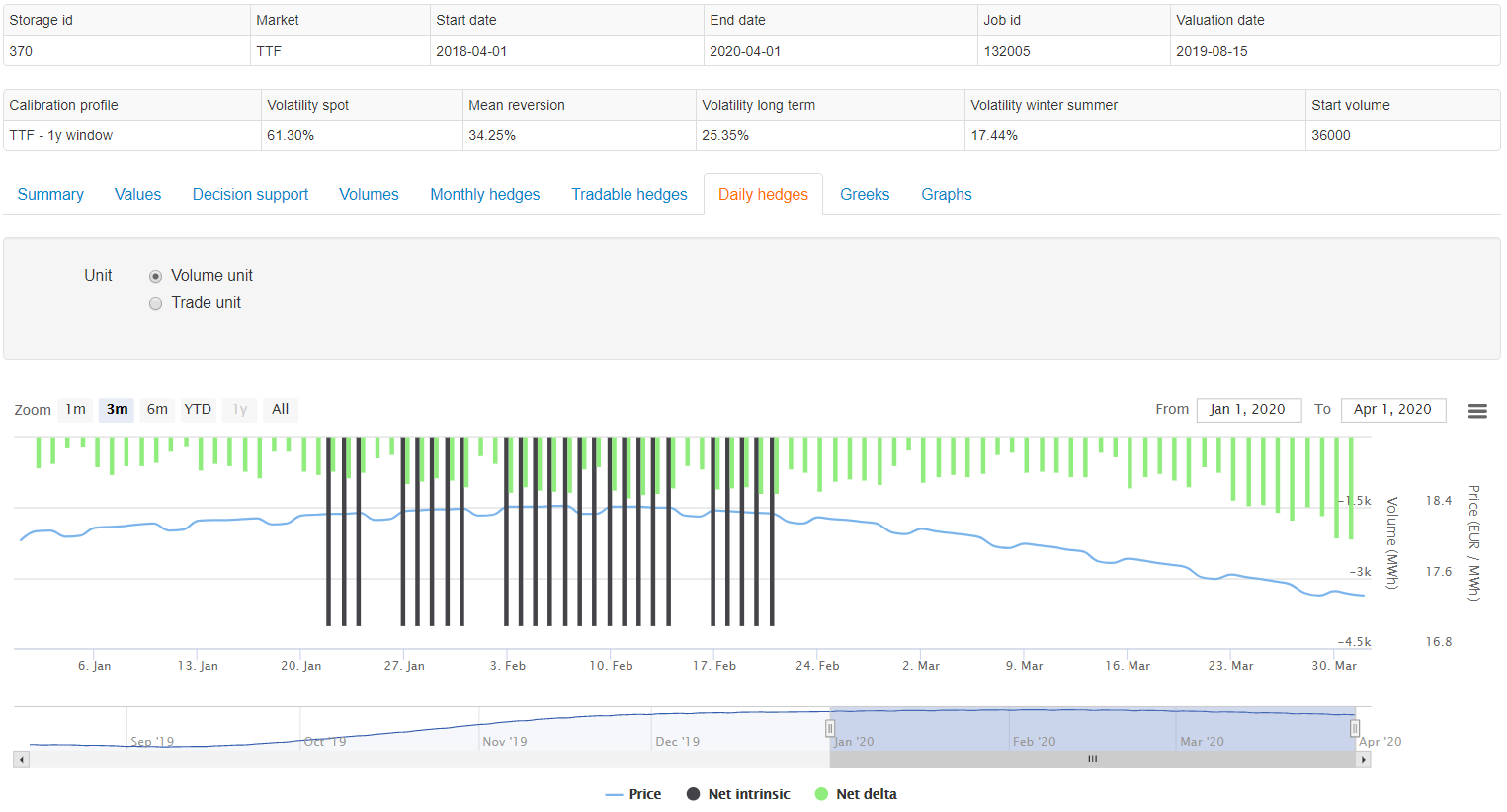

KYOS has a large number of gas storage operators among its clients. They use one of KYOS flagship products, KyStore, which is fully embedded in the KYOS Analytical Platform. With KyStore storage operators mainly perform the following activities:

- Quickly price new storage products which they offer to the market

- Decide about the optimal injection and withdrawals, as well as the forward hedge trades

- Value the existing contracts and positions; value new investments

KyStore is the preferred application for our customers because it brings together a unique user-friendly interface with best-in-class mathematics. Owners of natural gas storages value our web-based interface and the full connectivity with market prices, inventory levels and other relevant data. We can automate the whole workflow for you. The mathematics form the heart of the application, and ensure that the full flexibility value (extrinsic value) is captured, taking into account not only all storage conditions, but also market parameters.

KYOS has specialists who fully understand the challenges in gas markets. Furthermore, they provide dedicated support to you!

Loading a qoute..

Loading a qoute..

Solutions

Gas companies

Publications

- White paper: Benefits of outsourcing energy analytics

- Journal of Energy Markets: Gas storage valuation using a multi-factor price process

- Journal of Natural Gas Science and Engineering: Gas storage review article

- Journal of Derivatives: Gas storage valuation using a Monte Carlo method

- Improved shape TTF forward curve on pricecurves service

Trusted by organizations all over the world

Other Industries

Renewables

Sources of renewable power or green energy are the future. KYOS helps you with valuing your solar, wind, battery or pumped-hydro energy assets, as well as your (renewable) power purchase agreements (PPAs).

Read more ›Power

Where are power prices going? What is the value of my power station or contract? How can I trade in the market to reduce electricity price risks? KYOS analytics provide answers.

Read more ›Multi-commodity

Large industrial companies are exposed to a variety of commodities. To successfully operate in a competitive market, commodity earnings risk should be well understood and managed effectively.

Read more ›