What is a commodity accumulator?

An accumulator is a popular financial product in commodity markets. It is mostly used in agricultural commodity markets, such as corn, wheat, soybeans, sugar, cacao and coffee, but also in other markets like aluminium and copper.

There are two main elements of an accumulator: volume and price. The price is fixed, but the underlying volume accumulates over time depending on the price development of a reference futures contract.

Example of a basis commodity accumulator contract

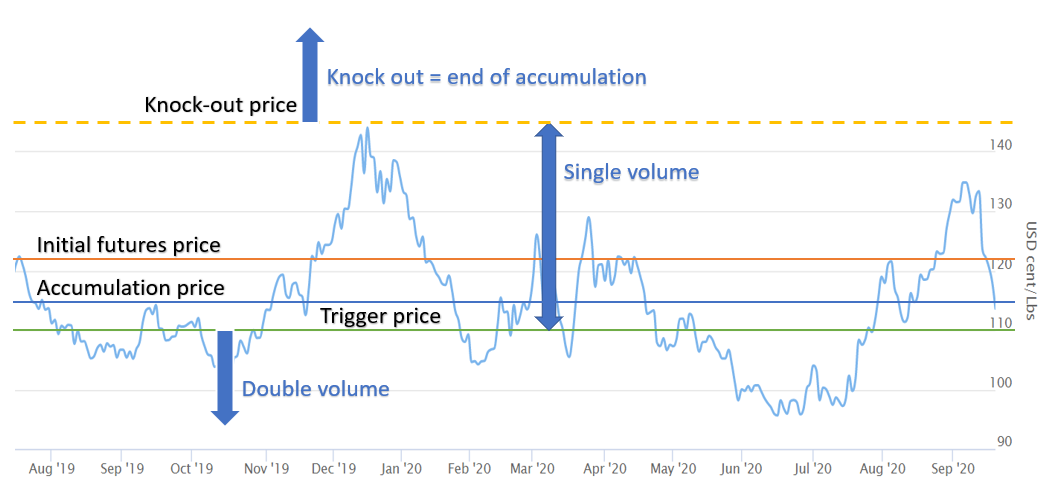

We take an accumulator contract on the September 2020 future for Coffee Arabica as an example. The accumulator is sold by a bank to a coffee blender at an accumulation price of 1.15 $/lbs, at a time when the futures contract is trading at 1.22 $/lbs. Between the signing date of the contract and the expiry date of the September 2020 future, the volume increases every day by 100,000 lbs. When the futures price drops below the trigger price of 1.10 $/lbs, however, the daily accumulation volume doubles. At the end of the contract period, the accumulator contract is financially settled. Suppose the total accumulation volume is 40 mln lbs and the settlement price is 1.19, then the bank pays the coffee blender 0.04 x 40 mln = 1.6 mln $. When the settlement price is below the accumulation price, the coffee blender pays the bank.

The double-up option

Without the double-up of the volumes below the trigger price, a bank would never offer this accumulator contract to the coffee company, because the price of 1.15 is below the current market price of 1.22 $/lbs. However, when the market price drops below the trigger price, it is likely that the bank will make money on the contract. Hence it is advantageous for the bank that volumes double. In fact, the relatively low price of 1.15 is financed by the bank with this exotic put option, which is embedded as a double-up in the accumulation contract.

The knock-out barrier option

Another element the bank could include is the inclusion of a knock-out option, a type of barrier option. With this knock-out option, the accumulation stops when the futures price rises above the knock-out price. This limits the potential losses for the bank. Both upsides for the bank allow it to sell the accumulator contract at an accumulation price below the current market price.

Additional accumulators

Accumulators are over-the-counter structures, allowing for many different forms. On top of the basis accumulator, a contract may have additional accumulators with their own accumulation prices, trigger prices and barrier options. At the initiation date of the contract, to avoid any upfront premium payments, the different price levels must be such that the initial mark-to-market value is zero.

Monte Carlo valuation of commodity accumulators

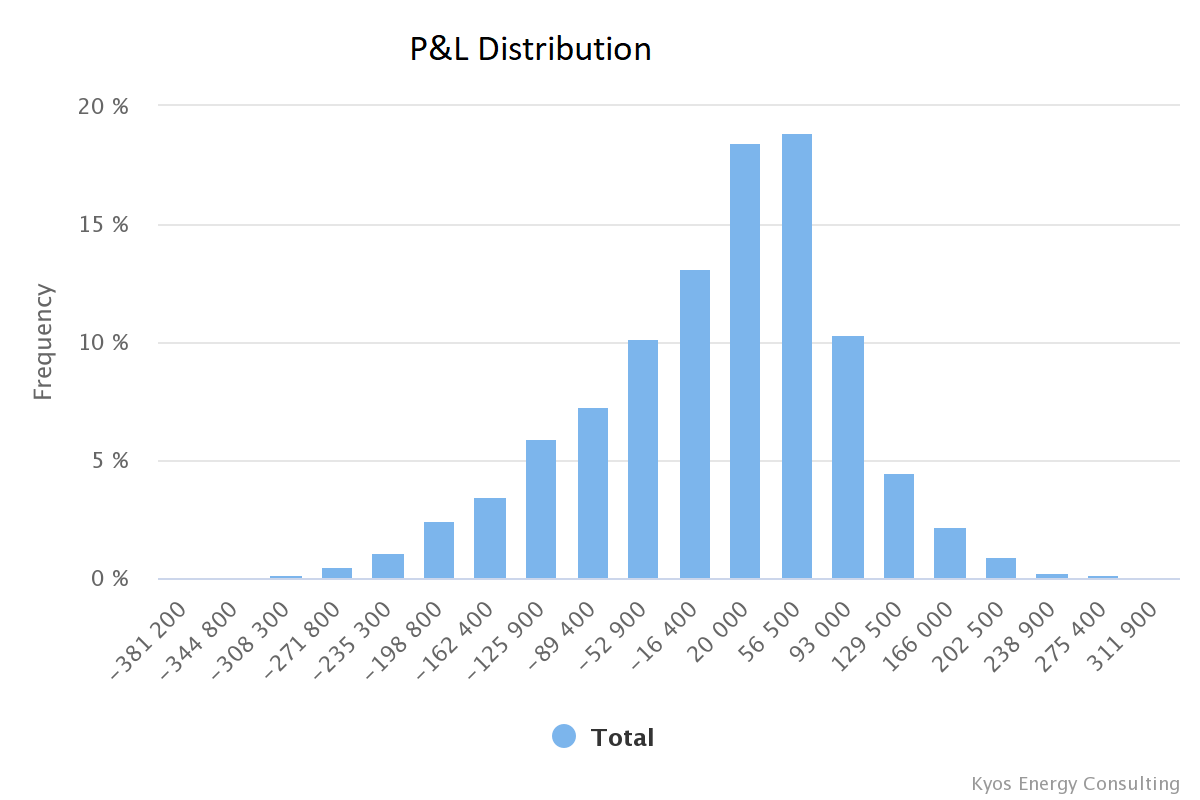

The best valuation methodology for these structures is based on Monte Carlo simulations, because the value of an accumulator depends on the price development over the entire accumulation period. The Monte Carlo valuation can yield a range of useful statistics, including a distribution of prices, volumes and mark-to-market.

Commodity accumulator contracts in the KYOS CTRM

The KYOS CTRM system is unique in its capability of capturing all types of accumulator contracts. For example, it shows the historical performance and the fair value of all the contracts. Plus the net position, exposures, mark-to-market and expected cash-flows, either stand-alone or in combination with the rest of your portfolio. The KYOS CTRM is a web based application which can easily interface with other systems and data providers. Click here to read more.