Green hydrogen

Green hydrogen is going to play a key role in the energy transition. Policy makers and market makers are therefore working hard to make this happen. There are various combinations of green power generation and electrolysis possible. Underneath we explain different examples of hydrogen business cases for which we provide advisory services.

KyH2 is the latest addition to our suite of stochastic optimization and valuation models. It helps owners and developers of (green) hydrogen projects in assessing the income stream of their plant or project. You can use this key information for example to:

- internal valuation purposes

- to identify the best hydrogen opportunities in the market

- for structuring and sizing projects

- to evaluate the risks

- and to report to investors and other stakeholders

We actively use KyH2 in our advisory practice, and will soon be able to provide access to our customers. Get in touch with us to know more details.

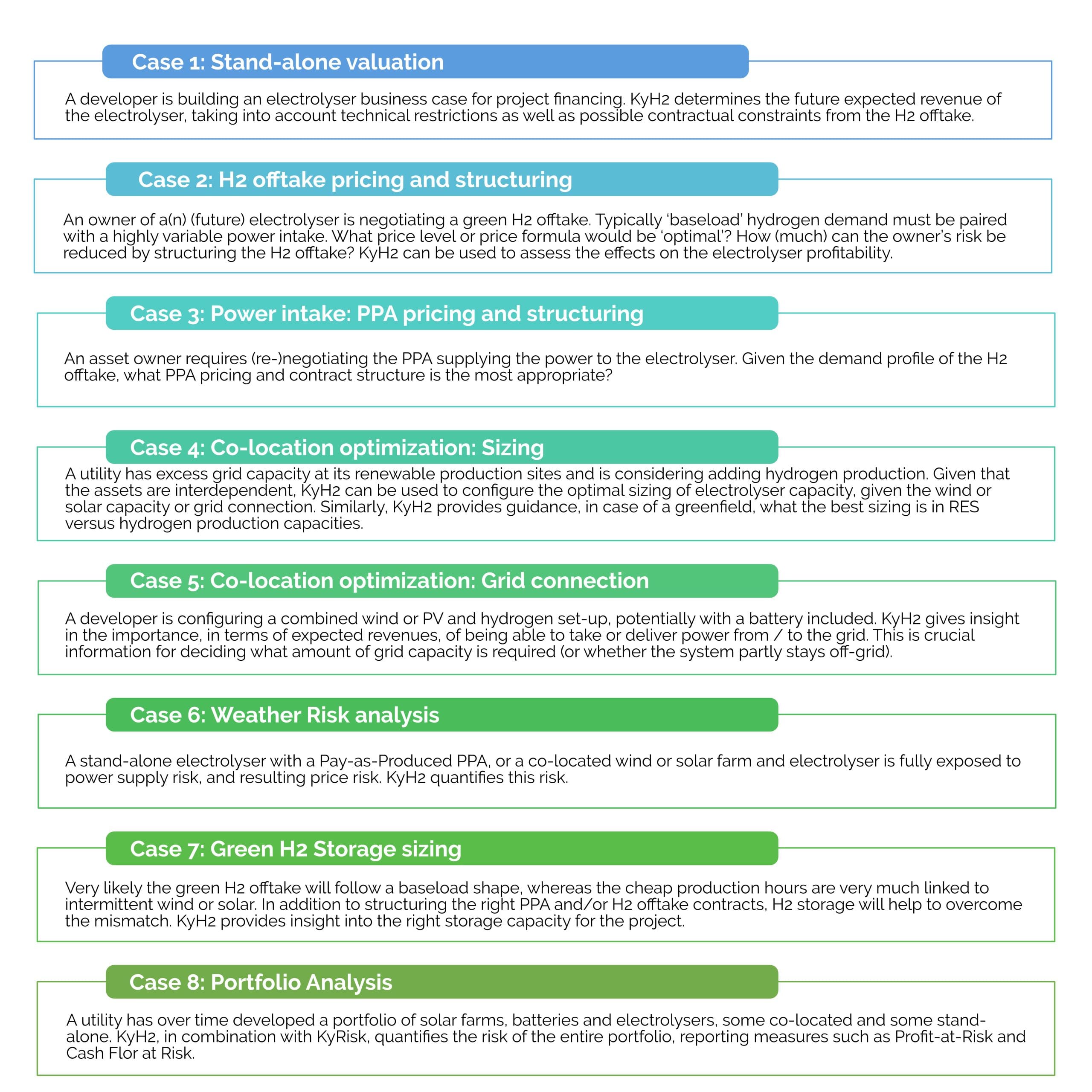

Case 1: Stand-alone valuation

A developer is building an electrolyser business case for project financing. KyH2 determines the future expected revenue of the electrolyser, taking into account technical restrictions as well as possible contractual constraints from the H2 offtake.

Case 2: H2 offtake pricing and structuring

An owner of a(n) (future) electrolyser is negotiating a green H2 offtake. Typically “baseload” hydrogen demand must be paired with a highly variable power intake. What price level or price formula would be “optimal”? How (much) can the owner’s risk be reduced by structuring the H2 offtake? In this situation, use KyH2 to assess the effects on the electrolyser profitability.

Case 3: Power intake: PPA pricing and structuring

An asset owner requires (re-)negotiating the PPA supplying the power to the electrolyser. Given the demand profile of the H2 offtake, what PPA pricing and contract structure is the most appropriate?

Case 4: Co-location optimization: Sizing

A utility has excess grid capacity at its renewable production sites and is considering adding hydrogen production. Given that the assets are interdependent, KyH2 can be used to configure the optimal sizing of electrolyser capacity, given the wind or solar capacity or grid connection. Similarly, KyH2 provides guidance, in case of a greenfield, what the best sizing is in RES versus hydrogen production capacities.

Case 5: Co-location optimization: Grid connection

A developer is configuring a combined wind or PV and hydrogen set-up, potentially with a battery included. KyH2 gives insight in the importance, in terms of expected revenues, of being able to take or deliver power from / to the grid. This is crucial information for deciding what amount of grid capacity is required (or whether the system partly stays off-grid).

Case 6: Weather Risk analysis

A stand-alone electrolyser with a Pay-as-Produced PPA, or a co-located wind or solar farm and electrolyser is fully exposed to power supply risk, and resulting price risk. KyH2 quantifies this risk.

Case 7: H2 Storage sizing

Very likely the green H2 offtake will follow a baseload shape, whereas the cheap production hours are very much linked to intermittent wind or solar. In addition to structuring the right PPA and/or H2 offtake contracts, H2 storage will help to overcome the mismatch. KyH2 provides insight into the right storage capacity for the project.

Case 8: Portfolio Analysis

A utility has over time developed a portfolio of solar farms, batteries and electrolysers, some co-located and some stand-alone. KyH2, in combination with KyRisk, quantifies the risk of the entire portfolio, reporting measures such as Profit-at-Risk and Cashflow-at-Risk.

Trusted by organizations all over the world

Other Industries

Power

Where are power prices going? What is the value of my power station or contract? How can I trade in the market to reduce electricity price risks? KYOS analytics provide answers.

Read more ›Renewable power

Sources of renewable power or green energy are the future. KYOS helps you with valuing your solar, wind, battery or pumped-hydro energy assets, as well as your (renewable) power purchase agreements (PPAs).

Read more ›Natural gas

Natural gas portfolio management is all about managing price and volume risks. KYOS helps to optimize natural gas storage and swing contracts, and trade in the markets to maximize the flexibility value.

Read more ›Green hydrogen

Green hydrogen is going to play a key role in the energy transition. Learn about the business cases for which we provide advisory services.

Read more ›Multi-commodity

Large industrial companies are exposed to a variety of commodities. To successfully operate in a competitive market, commodity earnings risk should be well understood and managed effectively.

Read more ›