Post event Energy Trading Week 2022

ETW London September

The Energy Trading Week in London attracted a large crowd of over 700 attendees this year. The two-day event gave industry experts from various disciplines like operations & technology, regulations & compliance, traders live, net zero, oil trading, LNG trading, and energy trading digitalization a platform to discuss current situations and challenges.

The Energy Trading Week in London attracted a large crowd of over 700 attendees this year. The two-day event gave industry experts from various disciplines like operations & technology, regulations & compliance, traders live, net zero, oil trading, LNG trading, and energy trading digitalization a platform to discuss current situations and challenges.

Cyriel de Jong was among the presenters and spoke about ‘Risk management of Renewable Assets’. To view his presentation: KYOS Cyriel de Jong – PPA hedging Energy Trading Week

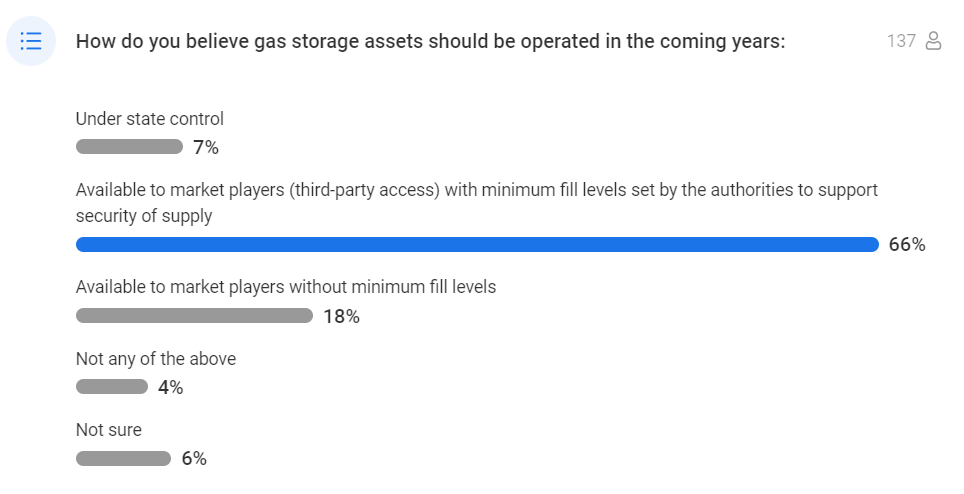

The Energy Trading Week was not only about renewables and net-zero. We were there as well to hear about and discuss about the gas market and developments in other segments of the energy sector. One of our poll questions was about the future of gas storage assets; it received a response from 137 delegates. The audience were quite unanimous – two thirds think that it should be managed by market players, with some involvement of the authorities, but not more than providing minimum fill levels. This is largely reflecting the current situation where governments set the fill level at 80%. But there is fear for further market interventions, which may not be beneficial to society.

If you wish to have a look what the European gas market is currently doing, have a look at site on European Gas Storage. You can see to which level storages are filled, and it includes LNG data.

The next edition of Energy Trading Week will also take place in London, UK: 17-18 October 2023. For more information: ENERGY TRADING WEEK – ETW

More information on financial aspects of renewable power

Have a look at the E-Book that Cyriel de Jong wrote on “The financials of renewable power and PPA’s”. It provides more insight in the various methods, for example used in long-term or short-term forecasting, creating simulations and price forecasts. Highly recommended! When you sign up for our newsletter, you will get free access to this E-Book.

(Renewable) PPA Valuation

To begin with, Power Purchase Agreements, or PPAs often include complex pricing structures. For example, PPA’s typically consist of price floors, risk sharing elements and specific reconciliation mechanisms. In order to value your assets, you need a system that is able to capture all this.

Basically, the KYOS renewable risk management system provides a complete picture of the electricity portfolio with renewable energy PPAs and related hedges. As an illustration, reporting includes volumetric position, mark-to-market value, value-at-risk and earnings-at-risk. All modules are part of the KYOS Analytical Platform, a cloud-based software platform. Contact us for a free demo! Info@kyos.com