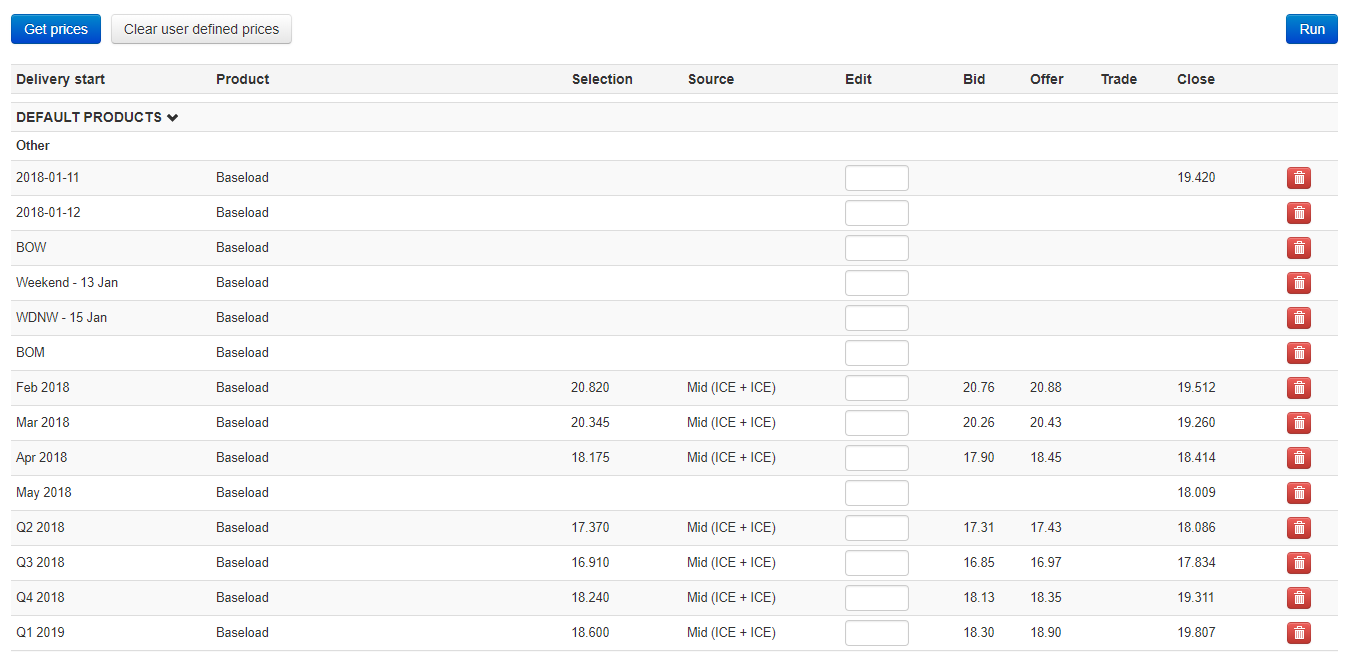

Live market price forward curves

- Live price forward curves based on real-time market data

- Interfaces with data providers

- Wide range of selection criteria available to define which live price data to use

- Fully integrated in KYOS Analytical Platform

Live forward curves are essential for competitive price quotations of contracts as well as intra-day assets valuations to define for example the optimal dispatch of a power plant.

Benefits

1. How do market trades and orders effect the price forward curve?

KyLiveCurve uses all relevant up to date market data to adjust the price forward curve. Besides, the user can define different criteria to define which live prices should be used and how. It is possible to schedule the KyLiveCurve model to run at regular times, or trigger it manually. Moreover, the model’s advanced methodology ensures that the price forward curve will always stay arbitrage free.

2. Different interfaces with market data possible

You can configure the KyLiveCurve model in different ways to get live market data. Furthermore, it is possible to enter manual prices for contracts that are not quoted in the market. This also allows the user to add its own market views and see the effect on the price forward curve.

3. Fast and Robust methodology

Having an up to date price forward curve is essential in a fast moving trading market to ensure the correct pricing of contracts and optimization of dispatch. Therefore, KyLiveCurve quickly recalculates the price forward curve based on actual trades and market orders.

Features

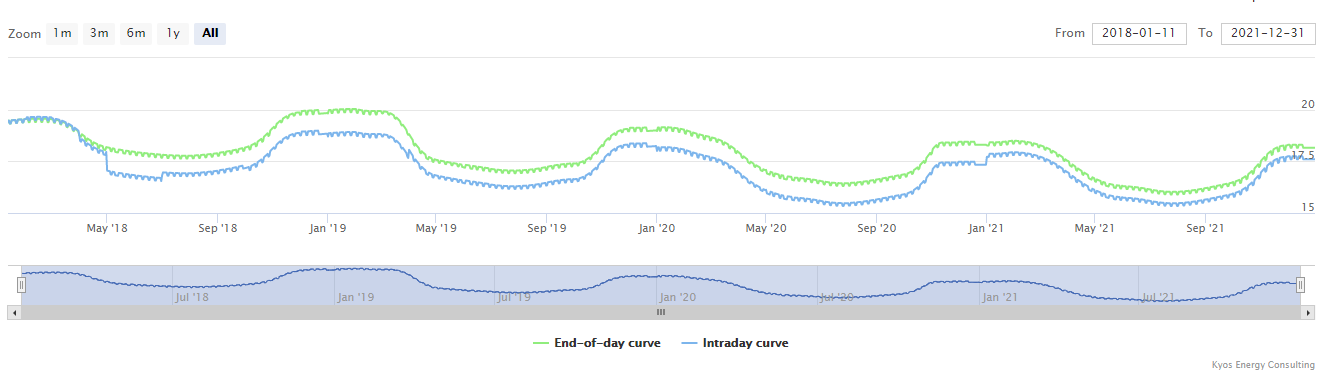

KyLiveCurve uses advanced statistics to adjust the end-of-day forward curve based on available live data.

Of course we have fully integrated KyLiveCurve in the KYOS Analytical Platform. Automated data feeds with exchanges and data providers ensure you have up-to-date prices! As a result, you always have the latest numbers ready for contract pricing, power plant dispatch or MtM calculations.

Methodology

KyLiveCurve applies an advanced statistical methodology to re-calculate price forward curves based on both end-of-day curves and live trade and order information. In addition, the user can define their own criteria – select for example certain contracts that should use live market data. Build your live price forward curve on of these three options:

- the mid-point of bid and offer,

- or based on bid only

- based on last trade done

Trusted by organizations all over the world

Other Solutions

Consulting services

KYOS Energy Consulting offers a wide range of services to support companies with managing their (renewable) production position. Our expert services range from a one-off deal valuation to a complete solution for the risk management of a portfolio of renewable generation assets and contracts.

Read more ›Optimization and valuation

KYOS offers fast and accurate solutions to value flexible assets and contracts in energy markets, such as power plants, gas storage facilities and swing contracts.

Read more ›Portfolio & risk management / CTRM

Does your company have a significant exposure to commodity prices? Then KYOS has a cost-effective solution for your daily management. The KYOS CTRM offers a detailed insight in your exposures, expected cash-flows, Mark-to-Market and more.

Read more ›Risk analytics

KYOS offers unique software for measuring portfolio risks in energy and commodity markets. The risk analytics include Value-at-Risk, Cashflow-at-Risk and Earnings-at-Risk.

Read more ›