Power market fundamentals

- Create power price forecasts and scenarios

- Get detailed results per power plant per hour

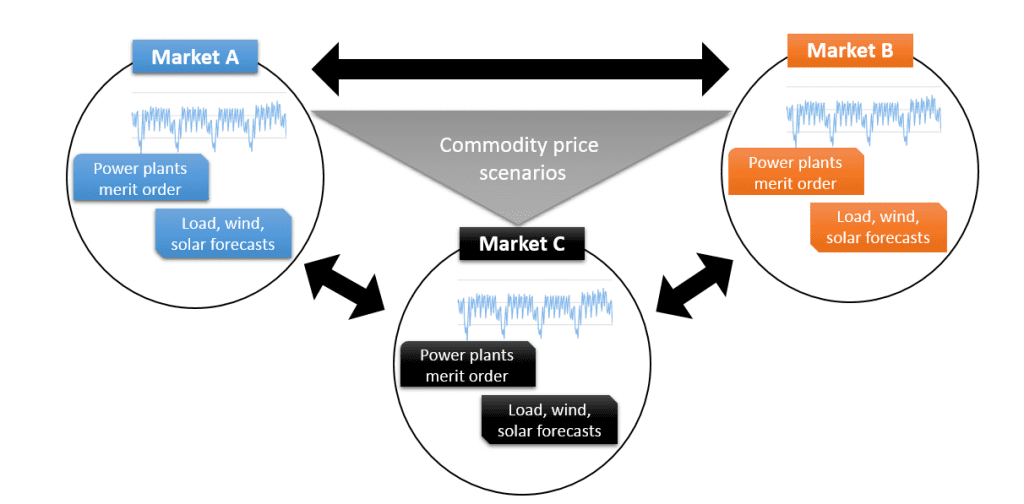

- Study multi-market, with interconnection capacities

- Enjoy user-friendly interface and fast calculations

KyPF has the unique feature of integrating Monte Carlo simulations into fundamental power market modelling. This provides a much broader perspective on potential future developments than a single forecast.

Designed to support all functions

For analysts: Rely on up-to-date market information and use our different Weather Year simulations, demand and supply balances as well as price forecasts to leverage your own analysis.

For analysts: Rely on up-to-date market information and use our different Weather Year simulations, demand and supply balances as well as price forecasts to leverage your own analysis.

Traders: KyPF enables you to identify mis-pricings in the market and quantify the levels of different risk premiums that are priced in. From this basis, our model helps you strengthen your trading strategies and turn insights into action.

KyPF also helps to answer strategic questions: By modeling scenarios 20+ years into the future, our fundamental model supports your long-term investment and planning decisions. It is key to understand and anticipate issues at play in power markets. New consumption patterns and technologies, increasing interconnection and renewable capacity, as well as fast regulatory changes are all driving factors and essential in your strategic decision-making process. Our model takes all of these factors into account.

Benefits of the KyPF model

1. Combine scenario analysis with fundamental modelling

The fundamental market model calculates the expected future power prices based on assumptions for fuel prices, demand, renewable production and interconnection capacities. Some of these assumptions may be quite uncertain, which is why the model works with different scenarios for fuel prices, demand and renewable production. This unique feature allows you to generate joint simulations of fuel and power prices. This broader perspective is essential for better trading and investment decisions.

2. Create future demand and renewable production

For a fundamental hourly optimization, you need detailed inputs for demand and renewable production. Based on capacity growth assumptions, a smart algorithm reshapes historical information into detailed forecasts, seamlessly integrating fundamental capacity forecasts in the KyPF model. Instead of a single forecast for the time series, you can also use a range of scenarios, reflecting the uncertainty in future market conditions.

3. Detailed inputs and outputs per power plant

The model provides detailed inputs for each conventional power plant, including capacities, start curves, efficiencies, operating costs, heat supply, and more. In the outputs we show exactly how each plant is dispatched. This allows you to see the contribution per power station to overall production and carbon emissions. As a result, this detailed information forms a solid basis for your strategic and policy decisions.

4. Optimize energy storage and other flexibility sources

Conventional power stations, running on fossil fuels, are the main price setters in most markets. However, the renewable energy growth is bringing energy storage more to the forefront. The KyPF model incorporates both pump-hydro and other energy storage facilities, such as batteries. Furthermore, it is possible to add other flexibility instruments and demand response mechanisms as well.

5. Optimize interconnection capacities between multiple areas

Power markets are generally interconnected to other power markets. This can be within the same country (such as Japan), or between countries. In KyPF the user can define inputs separately per area, as well as the transport capacities between the areas. The model then performs a joint optimization across all areas, making sure that electricity flows from high priced to low priced areas. Hence you will utilize capacities fully!

Loading a qoute..

Loading a qoute..

Features of the Power Market Fundamental model

KyPF calculates the optimal dispatch of hundreds or even thousands of power stations. You will get a detailed hourly modelling per power plant, including for instance start curves, maintenance periods, and run-times. Moreover, it models multiple markets simultaneously, thereby optimizing interconnection flows.

Of course, we have fully integrated KyPF in the KYOS Analytical Platform. With automated data feeds, you always have up-to-date fundamental curves available.

Full Transparency

Transparency is part of our core principles. We always show and mention our input data sources and modelling settings so that results can always be traced back to the underlying assumptions. In addition, the KyPF interface enables clients to tailor assumptions to their own needs. It is possible to customize the model inputs with your own datasets. In addition, we include the option to back-test our model and are fully transparent with its forecasting performance.

KYOS expertise

KyPF is supported by an experienced team of researchers and analysts that constantly enhance the modelling capabilities in order to be on top of the increasing complexities of power markets. They also closely monitor market developments and update data assumptions accordingly to ensure that the model runs reflect the latest state of the EU power market.

Price Analytics

Publications

- KyPF Fundamental Power Market Analysis - monthly update

- Combine fundamentals & Monte Carlo for better decisions

- Report: Multi billion euro loss for Dutch coal plants

- Journal of Energy Markets: Cointegration between gas and power spot prices

- Cointegration between power and fuel prices stronger than ever

Trusted by organizations all over the world

Other Solutions

Consulting services

KYOS Energy Consulting offers a wide range of services to support companies with managing their (renewable) production position. Our expert services range from a one-off deal valuation to a complete solution for the risk management of a portfolio of renewable generation assets and contracts.

Read more ›Optimization and valuation

KYOS offers fast and accurate solutions to value flexible assets and contracts in energy markets, such as power plants, gas storage facilities and swing contracts.

Read more ›Portfolio & risk management / CTRM

Does your company have a significant exposure to commodity prices? Then KYOS has a cost-effective solution for your daily management. The KYOS CTRM offers a detailed insight in your exposures, expected cash-flows, Mark-to-Market and more.

Read more ›Risk analytics

KYOS offers unique software for measuring portfolio risks in energy and commodity markets. The risk analytics include Value-at-Risk, Cashflow-at-Risk and Earnings-at-Risk.

Read more ›