End-of-Day market price forward curves

- Contains smart algorithm to calculate expected forward curves

- End-of-day curves based on settlement market data

- Applicable to power, gas and other commodity markets

- Available as a data service, and as software solution

End-of-day forward curves are widely used for marking-to-market all trading positions and are therefore a fundamental piece of information for any company active in the energy and commodity market.

Benefits

1. Get good end-of-day market price forward curves

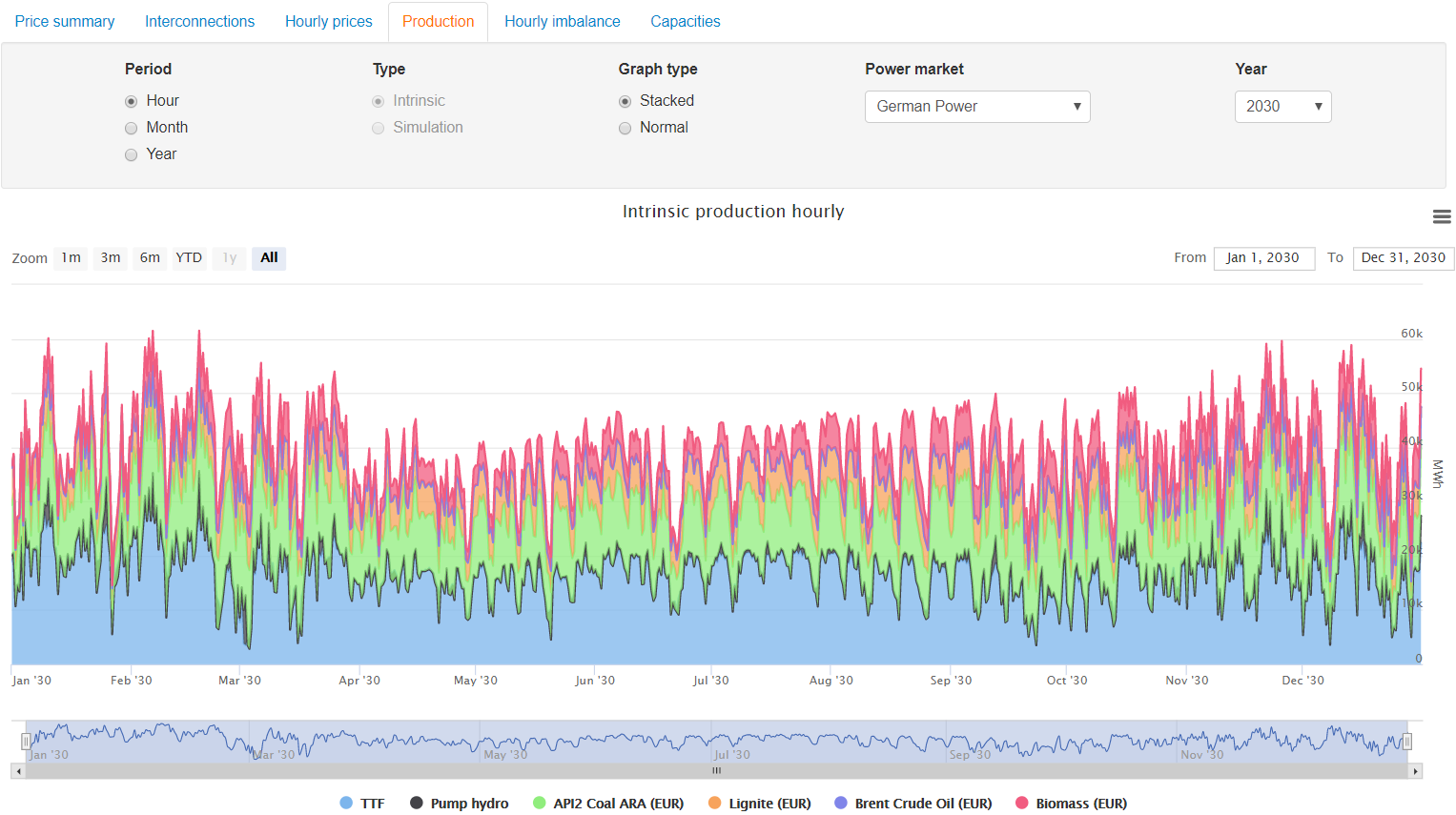

A good forward curve not only includes seasonal patterns, but also deviates between weekdays and weekends. It should furthermore incorporate public holidays, and contain the right level of variation between the hours. KyCurve performs all these tasks automatically when new settlement data arrive. Use the KyCurve model to construct detailed curves for power, gas and other commodity markets.

2. Integration with valuation and risk modules

it is possible to set the optimization and valuation models of the KYOS Analytical Platform in such a way that these models recalculate automatically. Each time KyCurve creates a new end-of-day market price forward curve, it will subsequently trigger the models. As a result, you will always have optimal pricing and hedging information, ready to use for trading and reporting purposes. Ideal for your decision making and price setting in energy and commodity markets!

3. Use advanced model or get price curves as a service

The KyCurve model can be delivered as a model in the KYOS Analytical Platform. This allows you for instance to schedule calculations based on your own settings and data feeds. Alternatively, KYOS offers price forward curves for many European power and gas markets as a service via www.pricecurves.com. Depending on your preference, you can choose between both possibilities.

Loading a qoute..

Loading a qoute..

Features

KyCurve uses advanced statistics to make an end-of-day forward curve based on available settlement data.

Of course we have fully integrated KyCurve in the KYOS Analytical Platform. Automated data feeds with exchanges and data providers ensure you always have the most recent end-of-day prices, which you can immediately use for your contract pricing, power plant dispatch or MtM calculations.

Methodology

KyCurve applies an advanced statistical methodology to calculate detailed price curves. Seasonal shapes are found based on historical relationships in forward markets. On the other hand, historical time series form the basis to filter weekday patterns. Furthermore, an innovative statistical routine determines the optimal daily and hourly shaping. And not to forget, the optimization algorithm takes the impact of public holidays and bridge days into account.

Price Analytics

Publications

- Live price curves for contract pricing and dispatch optimization

- White paper: Benefits of outsourcing energy analytics

- ET: How renewables shape the future in Germany

- KYOS report: Use renewable production information for a green price forward curve

- MRI and KYOS launch power price forward curves in Japan

Trusted by organizations all over the world

Other Solutions

Consulting services

KYOS Energy Consulting offers a wide range of services to support companies with managing their (renewable) production position. Our expert services range from a one-off deal valuation to a complete solution for the risk management of a portfolio of renewable generation assets and contracts.

Read more ›Optimization and valuation

KYOS offers fast and accurate solutions to value flexible assets and contracts in energy markets, such as power plants, gas storage facilities and swing contracts.

Read more ›Portfolio & risk management / CTRM

Does your company have a significant exposure to commodity prices? Then KYOS has a cost-effective solution for your daily management. The KYOS CTRM offers a detailed insight in your exposures, expected cash-flows, Mark-to-Market and more.

Read more ›Risk analytics

KYOS offers unique software for measuring portfolio risks in energy and commodity markets. The risk analytics include Value-at-Risk, Cashflow-at-Risk and Earnings-at-Risk.

Read more ›